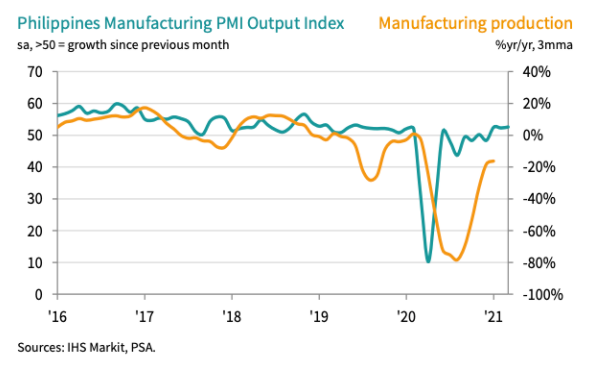

The Philippines manufacturing output has rebounded toward industry stabilization, seeing an optimistic projection in the near months as the government continues to conduct vaccination rollout and ease restriction protocols.

By April 2021, the monthly integrated survey of selected industries (MISSI) reported a leap in growth by 162.1% year-on-year, contrasting the 64.8% fall in the same month last year.

The movement towards stabilization spreads across businesses that have started to resume their operations alongside the recovering increase in overseas demands. In addition, the Philippines plans to gradually reopen the economy and increase the manufacturing operating capacity of sectors deemed essential.

Today, 20 out of 22 manufacturing sectors are growing in fast paces, with primary metals growing most significantly at 687.5%. In contrast, petroleum products and pharmaceuticals are yet to record positive growth.

However, the rising price of materials may become a critical area of concern. Manufacturers face surcharges and higher freight costs due to the shortage of accessible materials as the country's input price inflation keeps on accelerating to its sixth month in the running.

If the material prices stay on a rally, manufacturers would need to increase their output charges, risking reducing foreign manufacturing demand and putting the industry in a farther position to recover this year.

The materials shortage happened due to the severe pandemic-induced performance decline that affects the global supply chain, eventually increasing lead times and create raw materials' scarcity.

As a result, Philippines manufacturing firms need to address transportation bottlenecks and evident supply-side pressures.

One of the more dire shortages happened in the supply of semiconductor chips. The Philippines' chipmakers are racing to meet the demand for consumer electronics, especially now that consumer behavior has significantly shifted to online activities, notwithstanding the presence of the COVID-19 pandemic.

Following the event, The Semiconductor and Electronics Industries in the Philippines (SEIPI) set a 7% industry growth forecast this year, two percent higher than the pre-pandemic growth number of 5% despite the extended lead times the effect of global raw materials shortage.

SEIPI has stated its attempt to identify alternative component suppliers to settle the inevitable threat of shortage this year, further working with suppliers and clients to better forecast and manage procurements needed to continue the business.

Another material experiencing a global shortage worth noting is natural rubber. The Philippines' manufacturing firms face a 40 to 50 percent cost increase for rubber import due to its availability, forcing companies to maintain higher inventory levels and buy the materials despite its rising price to provide some cushion to their supply chain process.

The country's domestic production of rubber also results in delays in natural rubber recovery. The Philippines Statistics Authority reported a capacity of 155.18 thousand metric tonnes in December 2020, modestly growing from the previous years by 2.2 percent.

Regardless of the risk in the materials' supply, the latest reading of the Philippines Manufacturing PMI indicates a modest improvement in the sector's health.

Firms have shown signs of purchasing activity to boost pre-production inventories and expand their finished goods stocks. Comparatively, firms who choose not to accept the cost burdens in the rising expenses are partially rising factory-gate prices, leading to robust price inflation.

Leading the Charge: Major Players in SEA’s Digital Lending Market

The fintech lending market in SEA is poised for substantial growth, including digital lending which is set to surpass digital payments as the primary revenue driver for the region's digital financial services sector by 2025, with a compound annual growth rate (CAGR) of 33%. This growth is fueled by the widespread adoption of automated loan origination processes and the seamless integration of financial services into digital platforms.

Unlocking Opportunities in the SEA Digital Financial Services Landscape

In recent years, Southeast Asia (SEA) has emerged as a hotbed for fintech innovation, transforming the financial landscape across its diverse markets. This transformation is characterized by a surge in digital financial services (DFS), revolutionizing how individuals and businesses manage their finances. However, the journey is not without its challenges, and understanding these is crucial for stakeholders aiming to navigate this rapidly evolving sector.

How SEA Startups are Navigating Funding Challenges

The startup ecosystem in Southeast Asia (SEA) has long been a vibrant hub for innovation and growth. However, recent global economic shifts and the aftermath of the COVID-19 pandemic have ushered in a new era of funding challenges.

Challenges for Sustainable Recovery in Southeast Asia

Sustainable recovery in Southeast Asia faces numerous challenges, yet also presents significant opportunities for green growth. Addressing sustainable issues is crucial for achieving a resilient and sustainable future.